Trading currency pairs is ideal for people who have never dealt with investments before, as well as for those who have failed in other markets. With a little commitment, you can make a lot of profit on forex. Due to easy access to the market, entry is often decided by people who are looking for a job after work and would like to try something new. Which broker should you choose so that you won’t regret it later?

Which broker to choose if you want to invest in forex?

Individual investors can trade currency pairs thanks to forex brokers. These are companies that, in return for low fees and commissions, give customers access to advanced software that allows transactions. To access the so-called trading platform, you need to open an account with the broker and make a minimum deposit. There is a problem here, because there are many companies on the market and at first glance their offers are almost the same. Which broker to choose to get the most benefits from the investment? What matters most is the safety of funds. Therefore, before opening an account, make sure that the entity is licensed. It is also very important that it provides access to a good platform.

Which forex broker will be the best?

Which broker is the best for a given investor largely depends on his expectations and knowledge of the market. A trader who has been playing for many years and has invested tens or hundreds of thousands of zlotys on investments has different preferences, and an investor who is just entering the market and has little capital to choose from. There are, however, a few issues that are relevant to both the former and the latter.

Credibility

This is largely related to licensing. Investment firms are subject to numerous regulations. However, this does not mean that every subject that relates to himself is honest. There are still some on the market that work against the interests of customers. It is true that there are less and less of them, but you have to be careful. Before opening an account with a given broker, check by which entity and whether it is regulated at all.

Security of funds

It is worth mentioning the regulations again, but this time strictly in terms of the security of funds. When opening an account with a given broker, make sure how quickly he makes withdrawals and that there have been no problems with them so far. It is also best to choose an entity that belongs to an Investor Compensation Fund. Thanks to this, in the event of financial problems, you do not lose all your funds.

The amount of the spreads

Of course, an extremely important issue when it comes to which broker to choose is the amount of transaction costs. The lower the spreads the better. However, it should be remembered that in addition to these, the broker may charge other fees, so you need to carefully look at its offer.

Commissions and additional fees

In addition to spreads, the broker can charge clients for opening and closing orders, as well as for withdrawals. As for the first fee, it is especially painful for traders who employ scalping, a strategy of dealing with many trades in a very short time. Some companies also charge account maintenance fees. It is true that this happens less and less, but before opening an account, it is worth checking what this issue looks like with the selected broker. Perhaps additional conditions must be met for the account to be free.

The offer

The width of the offer should also be important for every investor. The greater the number of instruments available, the greater the chance of finding those on which trading will yield significant profits. When it comes to currency pairs, it is worth looking for a broker that offers not only the main ones, with the dollar, but also the exotic ones, based on the Polish zloty, Turkish lira or Hungarian forint. In addition, it would be good if the broker’s offer was enriched with CFDs on stock indices and other instruments.

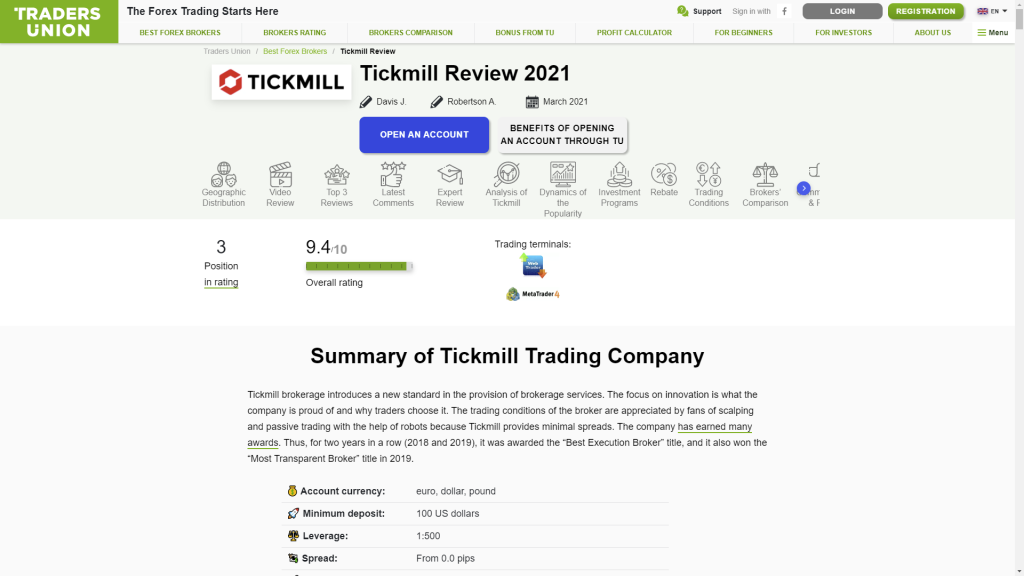

Tickmill Trading Company

It is also worth using ranking pages before choosing a broker and checking which entity is highly rated by their clients, because these opinions are the most important. When visiting tradersunion.com, we can find the Tickmill broker with an overall rating of 9.4 / 10 in a high position. Let’s take a closer look at the tickmill review. This trader meets all the above-mentioned conditions, as evidenced by winning the title of Best Execution Broker in 2018 and 2019 and Most Transparent Broker in 2019. The high ranking is also due to the company’s attitude towards innovation, as well as low commissions.

Advantages of trading with Tickmill:

- Spreads from 0 pips

- Any strategy is allowed

- Protection against negative balance

- Account currency: euro, dollar, pound

- Minimum deposit: 100 USD

- Leverage: 1:500

- Instruments: 62 currency pairs, stock indices, oil, gold and silver, bonds

- Margin call: 100%

- Stop Out: 30%